child tax credit payments continue in 2022

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. See what makes us different.

Will Child Tax Credit Payments Continue In 2022 Savingadvice Com Blog

Half of the enhanced sum was made.

. E-File Directly to the IRS. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

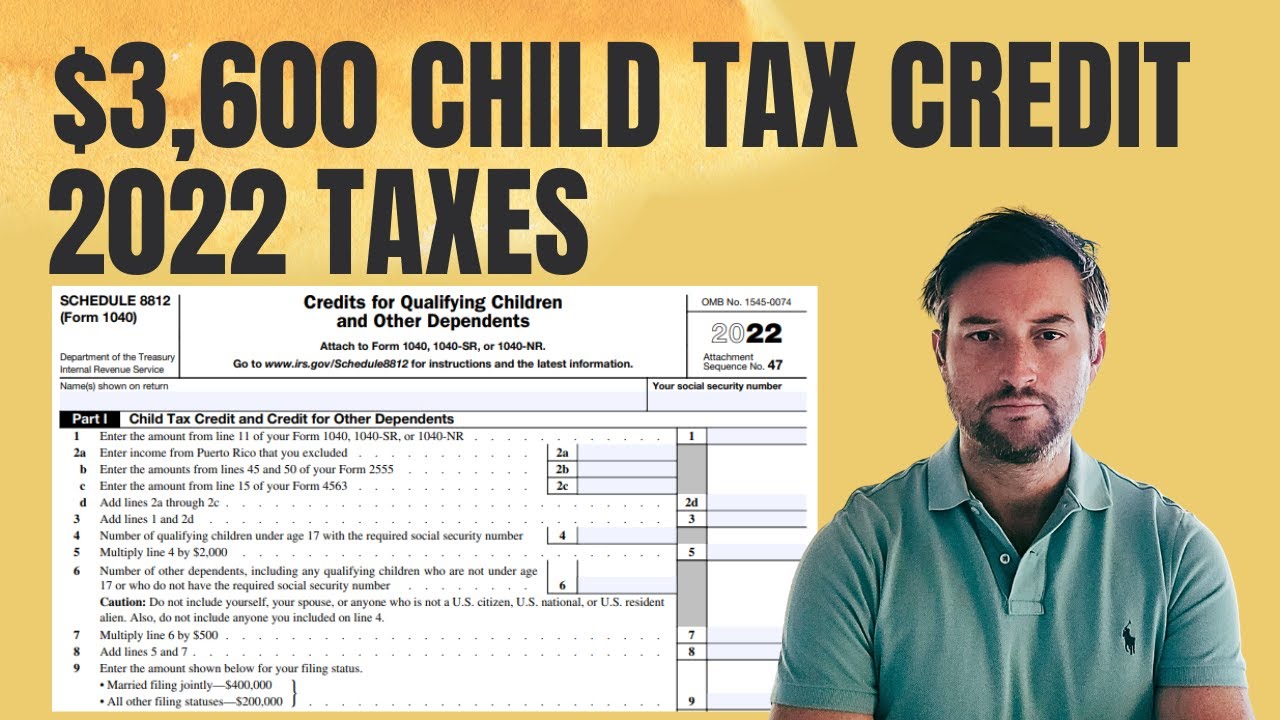

We dont make judgments or prescribe specific policies. Those returns would have information like income filing status and how many children are. The benefit for the 2021 year is 3000 and 3600 for children under the age of 6.

Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. The Internal Revenue Service. Learn More at AARP.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Continuing the expanded credit would have eased the effects of inflation on families. The Empire child tax credit in New York.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Instead the expanded Child Tax Credit payments expired at the end of 2021. Parents E-File to Get the Credits Deductions You Deserve.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. That means the child tax credit returns to a 2000 lump sum for individuals making up to 200000 and couples filing jointly who make up to 400000 with 1400. This credit begins to phase down to 2000 per child once household income reaches 75000.

In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of. Practical-Ad4637 5 days ago. I still dnt know ONE person that got there money from a 810 freeze.

The advance child tax credit payments were based on 2019 or 2020 tax returns on file. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. You can qualify for the full 2000 child tax credit if. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

The existing credit of 2000 per child under age 17 was increased to 3600 per child under 6 and 3000 per child ages 6 through 17. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

The maximum child tax credit amount will decrease in 2022. Ad Home of the Free Federal Tax Return. Rhode Island residents can similarly claim 250 per child and up to 750 for three children in a new initiative that has started this month.

Starting to think IRS not payin anybody with 810 freeze smh I been waiting for 4 months. During the worst of the pandemic expanded Child Tax Credit payments made a significant difference in the lives of millions of American households. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. 6 Often Overlooked Tax Breaks You Dont Want to Miss. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

To receive 2022 child tax credit payments families must wait until next years tax season.

2 000 Child Tax Credit 2022 Who Is Eligible For Payment As Usa

Families Won T See Child Tax Credit Payments For First Time In Six Months

Child Tax Credit 2022 Will Ctc Payments Finally Be Extended Marca

Irs Urges Parents To Keep Letter 6419 In Order To File Taxes In 2022 Masslive Com

The Monthly Child Tax Credit Payments Are Done Here S What Will Replace It Fortune

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Tag Child Tax Credit Nbc Connecticut

Do You Have Kids The Deadline To Claim Your Child Tax Credit Is Approaching Wric Abc 8news

3 600 Child Tax Credits Ctc For 2022 Will They Be Renewed Youtube

Build Back Better S Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

/cdn.vox-cdn.com/uploads/chorus_asset/file/23392681/1235261204.jpg)

Why Did Congress Let The Expanded Child Tax Credit Expire Vox

Child Tax Credit Payment Schedule For 2021 Kiplinger

Child Tax Credit Will Monthly Payments Continue In 2022 Abc10 Com

Child Tax Credit 2022 Extension Update Is It In The Biden Plan King5 Com

/cdn.vox-cdn.com/uploads/chorus_asset/file/23979633/GettyImages_1369365621.jpg)

Will Child Tax Credit Payments Continue In 2023 The Fight Is Not Over Vox

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Will Monthly Child Tax Credit Payments Be Extended Into 2022 Fast Forward Accounting Solutions

Will The Monthly Child Tax Credit Payment Be Extended Next Year The Us Sun